# Tokenomics

Swapsicle V2 introduces a dual token economy which includes the native DEX token SLUSH and the reward token ICE. SLUSH is utilized for trading while the ICE token is utilized in “The Igloo” product suite to earn and boost additional yield. ICE is also used for staking to obtain Swapsicle’s utility NFT Ice Cream Zombie Club. There is a max supply of 25 million tokens. However the future decision of supply will be in control by the DAO.

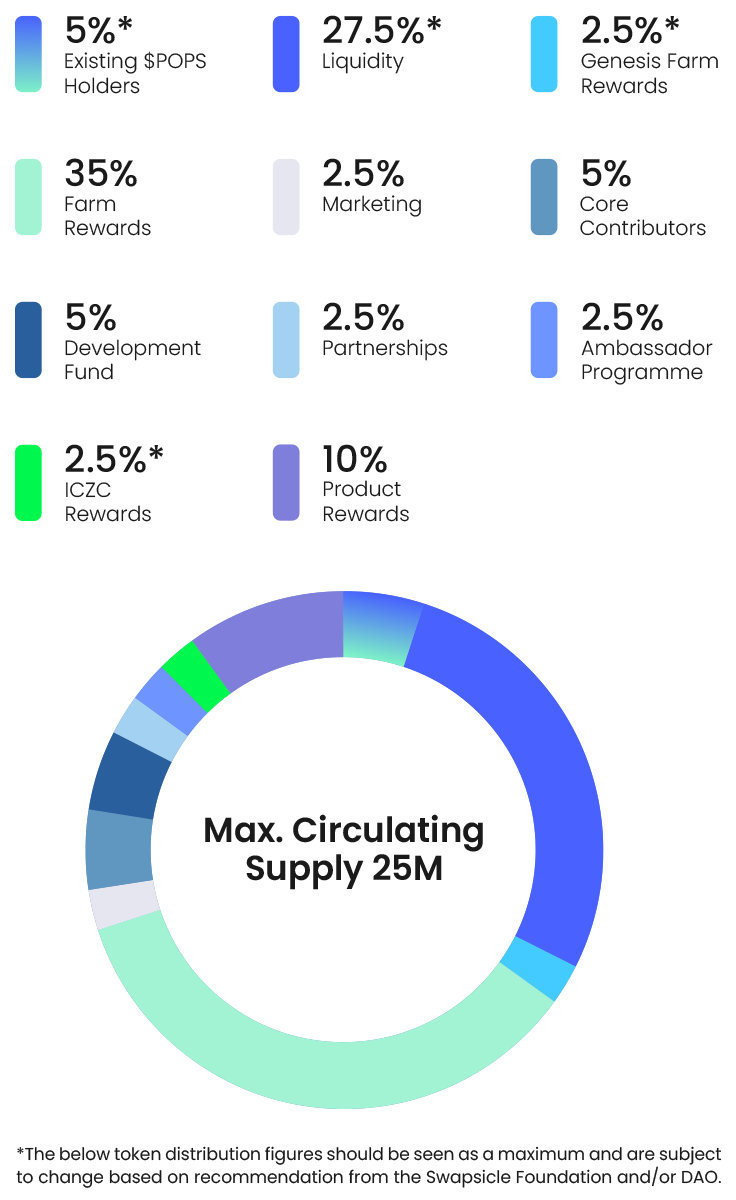

# Token Distribution Infographic

# Token Distribution

Existing $POPS Holders: 5%* of the SLUSH tokens will be allocated to existing $POPS token holders. This distribution rewards early supporters and incentivizes their continued participation in the platform. 100:1 for ICE or alternatively 110:1 for SLUSH.

Liquidity: Up to 27.5% of the SLUSH tokens will be allocated to liquidity provision. These tokens will be used to bootstrap liquidity on the Swapsicle platform, ensuring ample liquidity depth for trading pairs. This allocation supports a vibrant and liquid trading ecosystem.

*Genesis Farm rewards: 2.5% allocated to Genesis LP farm rewards. 80% to be paid out in ICE with optional defrosting with 20% to be paid out in SLUSH. Genesis Farm rewards to be distributed linearly over the first 6 months.

Farm Rewards: 35% of the SLUSH tokens will be allocated for farming rewards to be paid out in ICE. These tokens will be distributed as rewards to liquidity providers who contribute to the platform's liquidity pools. Farm rewards incentivize liquidity provision, driving participation and ensuring a robust trading environment. The will be distributed after ‘genesis farm rewards’ have completed emission and will be distributed linearly over a 5 year period.

Marketing: 2.5% of the SLUSH tokens will be allocated for marketing purposes. These tokens will be used to raise awareness, promote the Swapsicle platform, and attract new users and liquidity to the ecosystem. Marketing efforts play a crucial role in expanding the user base and driving the adoption of Swapsicle. These will be linearly distributed over a period of 4 years.

Core Contributors: 5% of the SLUSH tokens will be allocated to core contributors. 2 year vest with a 6 month cliff.

Development fund: 5% allocated to the development fund which will be distributed linearly over a 3 year period.

Partnerships: 2.5% of the SLUSH tokens will be allocated to partnerships to help with sustainable growth of the Swapsicle eco-system. 2 year vest with 6 month cliff and will be distributed in ICE tokens with an optional vesting period. Most partners will have their tokens featured in the Genesis pools.

Ambassador programme: 2.5% of SLUSH tokens will be allocated to the ambassador programme and will be distributed in ICE tokens. 2 year vest with a 6 month cliff.

Ice Cream Zombie Club Rewards: Up to 2.5% to be distributed linearly over a 4 year period.

Product rewards 10%: Swapsicle has key community participation incentive products such as Swap to play, Ice Box, Ice Vault and any products yet to be launched. 25% will go towards these products and will be distributed linearly over a 4 year period.

# Deflationary Mechanisms

Swapsicle V2 offers new deflationary mechanisms built directly into the SLUSH and ICE token.

22.5% of the swap fees generated on the platform are used to buy back SLUSH off the market and sent to a burn address that will be publicly available.

When utilizing ICE tokens in the Igloo, some of the products have de-allocation fees which help burn and reduce the supply of ICE.

Users who wish to defrost their ICE tokens into SLUSH for less than 90 days will also not receive a full 1:1 ratio, further creating a deflationary mechanism.

# Fee Distribution

Swapsicle V2 will offer a unique opportunity for dynamic swap fees on liquidity pools, utilizing Algebra Finance 2.0 technology. Below is a breakdown of the distribution of fees generated from swap fees that can range from 0.01-1.5% of the amount swapped.

Liquidity providers:

A significant portion of the transaction fees, 54.5%, is allocated to liquidity providers who contribute to the trading pairs on Swapsicle.

Ice Cream Van:

A percentage, usually 10%, of the transaction fees is allocated to the Ice Cream Van.

Zombie Van:

Zombie Van, a revolutionary product that allows users to reap the benefits of DeFi rewards like never before. With the Zombie Van, users gain access to a 5% share of transaction fees, enhancing their passive income potential within the DeFi ecosystem.

Buyback and Burn:

A certain percentage, typically 22.5%, of the transaction fees is allocated for a buyback and burn mechanism. These funds are used to buy back SLUSH tokens from the market, reducing the token supply and potentially increasing its value over time. The bought-back tokens are then burned, permanently removing them from circulation, contributing to increased scarcity and potential value appreciation.

Core contributors:

5% of the transaction fees is allocated to core contributors. This allocation is dedicated to supporting the development, marketing, and expansion of the Swapsicle platform. The funds are utilized to drive innovation, improve user experience, and foster the growth of the ecosystem.

Algebra:

3% of the transaction fees are allocated to Algebra for the technical implementation of the Algebra technologies.

*If a user chooses to opt in to managed liquidity, there is a 15% fee taken. The APR displayed on the site already factors in the 15% fee.

Fee Distribution is subject to change, which will be under the control of the DAO.

# De-Allocation Fees

On certain Igloo suite products, there are de-allocation fees when a user removes their ICE from a particular staking mechanism. These fees are deducted from the ICE rewards earned at the time of withdrawal. These fees range and are noted on the products themselves within the Igloo. The ICE collected from the de-allocation fees are burned from circulation.